Can You Take Bonus Depreciation On Commercial Rental Property . 27, 2017, and before jan. bonus depreciation accelerates this and instead of claiming $1,000 a year for seven years, you can claim bonus depreciation and write down more of the cost sooner. businesses may take 100% bonus depreciation on qualified property both acquired and placed in service after sept. below, we will discuss all aspects of bonus depreciation, including what it is and how it can help you save money for your residential rental property or commercial! To qualify, the property must be placed in service before december 31st of the year in which it was purchased. qualifying for bonus depreciation on a rental property can save you thousands of dollars in taxes over the life of the investment. you cannot deduct the cost of the property when you calculate your net rental income for the year. In 2022, you could claim 100% of your cabinet depreciation, meaning you’d get to write off the full $10,000 expense immediately.

from www.online-accounting.net

businesses may take 100% bonus depreciation on qualified property both acquired and placed in service after sept. 27, 2017, and before jan. bonus depreciation accelerates this and instead of claiming $1,000 a year for seven years, you can claim bonus depreciation and write down more of the cost sooner. To qualify, the property must be placed in service before december 31st of the year in which it was purchased. below, we will discuss all aspects of bonus depreciation, including what it is and how it can help you save money for your residential rental property or commercial! In 2022, you could claim 100% of your cabinet depreciation, meaning you’d get to write off the full $10,000 expense immediately. you cannot deduct the cost of the property when you calculate your net rental income for the year. qualifying for bonus depreciation on a rental property can save you thousands of dollars in taxes over the life of the investment.

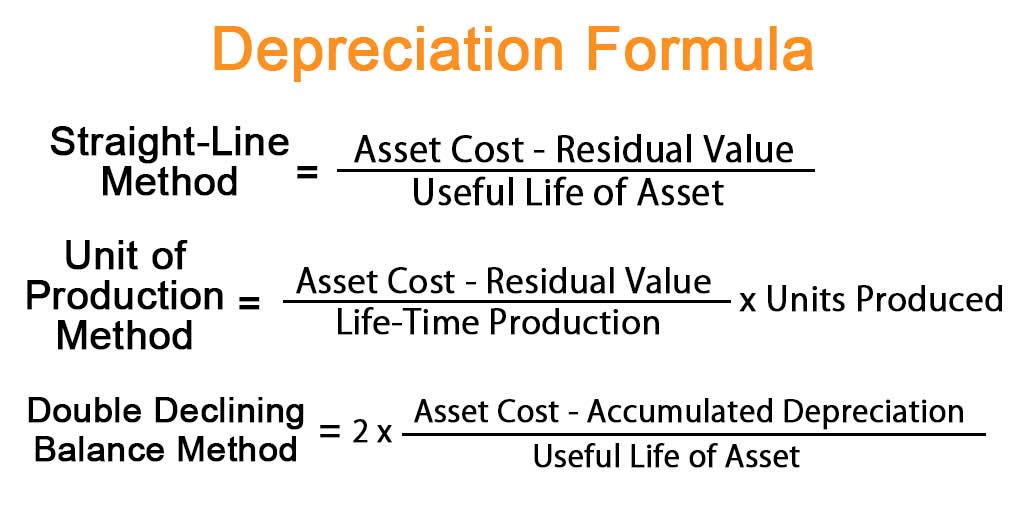

Straight Line Depreciation Method Online Accounting

Can You Take Bonus Depreciation On Commercial Rental Property In 2022, you could claim 100% of your cabinet depreciation, meaning you’d get to write off the full $10,000 expense immediately. qualifying for bonus depreciation on a rental property can save you thousands of dollars in taxes over the life of the investment. you cannot deduct the cost of the property when you calculate your net rental income for the year. bonus depreciation accelerates this and instead of claiming $1,000 a year for seven years, you can claim bonus depreciation and write down more of the cost sooner. 27, 2017, and before jan. below, we will discuss all aspects of bonus depreciation, including what it is and how it can help you save money for your residential rental property or commercial! businesses may take 100% bonus depreciation on qualified property both acquired and placed in service after sept. In 2022, you could claim 100% of your cabinet depreciation, meaning you’d get to write off the full $10,000 expense immediately. To qualify, the property must be placed in service before december 31st of the year in which it was purchased.

From corporatefinanceinstitute.com

Depreciation Schedule Guide, Example of How to Create a Schedule Can You Take Bonus Depreciation On Commercial Rental Property bonus depreciation accelerates this and instead of claiming $1,000 a year for seven years, you can claim bonus depreciation and write down more of the cost sooner. you cannot deduct the cost of the property when you calculate your net rental income for the year. below, we will discuss all aspects of bonus depreciation, including what it. Can You Take Bonus Depreciation On Commercial Rental Property.

From www.fool.com

What Is Bonus Depreciation A Small Business Guide Can You Take Bonus Depreciation On Commercial Rental Property bonus depreciation accelerates this and instead of claiming $1,000 a year for seven years, you can claim bonus depreciation and write down more of the cost sooner. To qualify, the property must be placed in service before december 31st of the year in which it was purchased. 27, 2017, and before jan. businesses may take 100% bonus depreciation. Can You Take Bonus Depreciation On Commercial Rental Property.

From calliyursulina.pages.dev

Bonus Depreciation 2024 Rental Property Calculator Betsy Charity Can You Take Bonus Depreciation On Commercial Rental Property In 2022, you could claim 100% of your cabinet depreciation, meaning you’d get to write off the full $10,000 expense immediately. To qualify, the property must be placed in service before december 31st of the year in which it was purchased. 27, 2017, and before jan. bonus depreciation accelerates this and instead of claiming $1,000 a year for seven. Can You Take Bonus Depreciation On Commercial Rental Property.

From sailsojourn.com

8 ways to calculate depreciation in Excel (2023) Can You Take Bonus Depreciation On Commercial Rental Property 27, 2017, and before jan. To qualify, the property must be placed in service before december 31st of the year in which it was purchased. qualifying for bonus depreciation on a rental property can save you thousands of dollars in taxes over the life of the investment. below, we will discuss all aspects of bonus depreciation, including what. Can You Take Bonus Depreciation On Commercial Rental Property.

From owlcation.com

Methods of Depreciation Formulas, Problems, and Solutions Owlcation Can You Take Bonus Depreciation On Commercial Rental Property businesses may take 100% bonus depreciation on qualified property both acquired and placed in service after sept. 27, 2017, and before jan. qualifying for bonus depreciation on a rental property can save you thousands of dollars in taxes over the life of the investment. To qualify, the property must be placed in service before december 31st of the. Can You Take Bonus Depreciation On Commercial Rental Property.

From www.lumpkinagency.com

Bonus Depreciation 2021 Bonus Depreciation on Real Estate Can You Take Bonus Depreciation On Commercial Rental Property In 2022, you could claim 100% of your cabinet depreciation, meaning you’d get to write off the full $10,000 expense immediately. qualifying for bonus depreciation on a rental property can save you thousands of dollars in taxes over the life of the investment. you cannot deduct the cost of the property when you calculate your net rental income. Can You Take Bonus Depreciation On Commercial Rental Property.

From www.youtube.com

How Bonus Depreciation Can be Used for Your Rental Properties YouTube Can You Take Bonus Depreciation On Commercial Rental Property qualifying for bonus depreciation on a rental property can save you thousands of dollars in taxes over the life of the investment. 27, 2017, and before jan. In 2022, you could claim 100% of your cabinet depreciation, meaning you’d get to write off the full $10,000 expense immediately. you cannot deduct the cost of the property when you. Can You Take Bonus Depreciation On Commercial Rental Property.

From wealthfit.com

How to Deduct Rental Property Depreciation WealthFit Can You Take Bonus Depreciation On Commercial Rental Property below, we will discuss all aspects of bonus depreciation, including what it is and how it can help you save money for your residential rental property or commercial! businesses may take 100% bonus depreciation on qualified property both acquired and placed in service after sept. 27, 2017, and before jan. bonus depreciation accelerates this and instead of. Can You Take Bonus Depreciation On Commercial Rental Property.

From dxotodjvx.blob.core.windows.net

How Long Can You Depreciate Commercial Real Estate at Bert Burgos blog Can You Take Bonus Depreciation On Commercial Rental Property To qualify, the property must be placed in service before december 31st of the year in which it was purchased. qualifying for bonus depreciation on a rental property can save you thousands of dollars in taxes over the life of the investment. bonus depreciation accelerates this and instead of claiming $1,000 a year for seven years, you can. Can You Take Bonus Depreciation On Commercial Rental Property.

From calliyursulina.pages.dev

Bonus Depreciation 2024 Rental Property Calculator Betsy Charity Can You Take Bonus Depreciation On Commercial Rental Property businesses may take 100% bonus depreciation on qualified property both acquired and placed in service after sept. To qualify, the property must be placed in service before december 31st of the year in which it was purchased. below, we will discuss all aspects of bonus depreciation, including what it is and how it can help you save money. Can You Take Bonus Depreciation On Commercial Rental Property.

From www.rent.com.au

How is property depreciation calculated? Rent Blog Can You Take Bonus Depreciation On Commercial Rental Property In 2022, you could claim 100% of your cabinet depreciation, meaning you’d get to write off the full $10,000 expense immediately. 27, 2017, and before jan. below, we will discuss all aspects of bonus depreciation, including what it is and how it can help you save money for your residential rental property or commercial! qualifying for bonus depreciation. Can You Take Bonus Depreciation On Commercial Rental Property.

From atgtitle.com

How Rental Property Depreciation Works & The Benefits to You Can You Take Bonus Depreciation On Commercial Rental Property 27, 2017, and before jan. qualifying for bonus depreciation on a rental property can save you thousands of dollars in taxes over the life of the investment. below, we will discuss all aspects of bonus depreciation, including what it is and how it can help you save money for your residential rental property or commercial! In 2022, you. Can You Take Bonus Depreciation On Commercial Rental Property.

From www.buildium.com

Bonus Depreciation Saves Property Managers Money Buildium Can You Take Bonus Depreciation On Commercial Rental Property qualifying for bonus depreciation on a rental property can save you thousands of dollars in taxes over the life of the investment. businesses may take 100% bonus depreciation on qualified property both acquired and placed in service after sept. below, we will discuss all aspects of bonus depreciation, including what it is and how it can help. Can You Take Bonus Depreciation On Commercial Rental Property.

From businessfirstfamily.com

Popular Depreciation Methods To Calculate Asset Value Over The Years Can You Take Bonus Depreciation On Commercial Rental Property businesses may take 100% bonus depreciation on qualified property both acquired and placed in service after sept. In 2022, you could claim 100% of your cabinet depreciation, meaning you’d get to write off the full $10,000 expense immediately. 27, 2017, and before jan. qualifying for bonus depreciation on a rental property can save you thousands of dollars in. Can You Take Bonus Depreciation On Commercial Rental Property.

From www.baselane.com

Rental Property Depreciation All You Need to Know Baselane Can You Take Bonus Depreciation On Commercial Rental Property bonus depreciation accelerates this and instead of claiming $1,000 a year for seven years, you can claim bonus depreciation and write down more of the cost sooner. below, we will discuss all aspects of bonus depreciation, including what it is and how it can help you save money for your residential rental property or commercial! In 2022, you. Can You Take Bonus Depreciation On Commercial Rental Property.

From wealthfit.com

How to Deduct Rental Property Depreciation WealthFit Can You Take Bonus Depreciation On Commercial Rental Property you cannot deduct the cost of the property when you calculate your net rental income for the year. In 2022, you could claim 100% of your cabinet depreciation, meaning you’d get to write off the full $10,000 expense immediately. below, we will discuss all aspects of bonus depreciation, including what it is and how it can help you. Can You Take Bonus Depreciation On Commercial Rental Property.

From dxotodjvx.blob.core.windows.net

How Long Can You Depreciate Commercial Real Estate at Bert Burgos blog Can You Take Bonus Depreciation On Commercial Rental Property bonus depreciation accelerates this and instead of claiming $1,000 a year for seven years, you can claim bonus depreciation and write down more of the cost sooner. below, we will discuss all aspects of bonus depreciation, including what it is and how it can help you save money for your residential rental property or commercial! qualifying for. Can You Take Bonus Depreciation On Commercial Rental Property.

From calliyursulina.pages.dev

Bonus Depreciation 2024 Rental Property Calculator Betsy Charity Can You Take Bonus Depreciation On Commercial Rental Property you cannot deduct the cost of the property when you calculate your net rental income for the year. qualifying for bonus depreciation on a rental property can save you thousands of dollars in taxes over the life of the investment. 27, 2017, and before jan. bonus depreciation accelerates this and instead of claiming $1,000 a year for. Can You Take Bonus Depreciation On Commercial Rental Property.